|

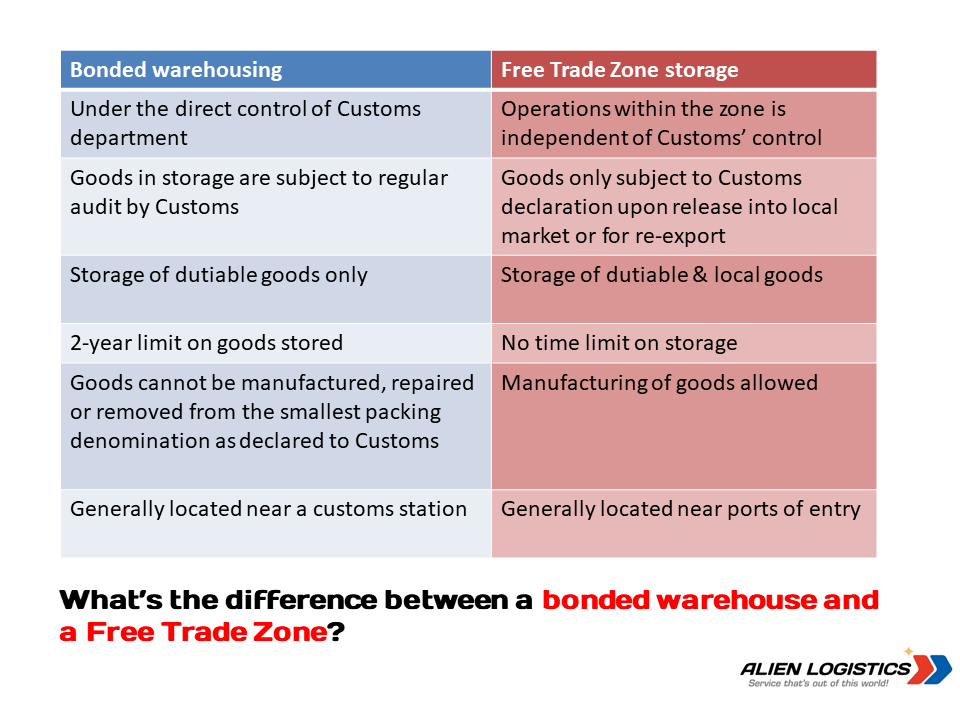

Using a Free Trade Zone (FTZ) can benefit any importer or exporter - from large manufacturers to sole proprietors. Operations within an FTZ can help in significantly reducing costs from customs duties, taxes and tariffs; improve global market competitiveness; and minimize bureaucratic regulations. In the United States, an FTZ is also known as a Foreign-Trade Zone. Below are some benefits of using an FTZ. Elimination, deferral or reduction of certain duties. Companies can bring goods into the FTZ without duties or most fees, making FTZs the most attractive Customs program for importer/exporters. Raw material vs finished goods tax. In some cases, locally produced component items or imported raw materials have a higher duty rate than the finished product, putting a local manufacturer at a cost disadvantage to an importer of finished items. However, by participating in an FTZ, the local manufacturer pays the duty on the finished item only as it enters the local market. In many cases the tariff of the manufactured good is zero, eliminating any costs associated with importing raw materials and goods. As bonded warehouses do not allow for manufacturing on their premises, the only way to take advantage of this tariff-saving method is to operate within an FTZ.

Improved compliance, inventory tracking, and quality control. Physically going to the grocery store allows you to get a better feel of the goods you buy. In a similar sense, operating in an FTZ allows companies to better track their inventory, without incurring additional inspection costs. By bringing goods into an FTZ warehouse that you control, you can identify and classify goods at the warehouse instead of at the port at a Customs control location or only getting to inspect the goods after duties have been paid then finding discrepancies. Indefinite storage. A company can hold its goods indefinitely in an FTZ until an opportunity to export, re-export or if there are local quotas on a particular type of goods. Once the quota has been lifted or becomes available, they can enter into local commerce. No SST or customs duties on zone-to-zone transfers. The really useful thing about FTZs is that goods can be transferred from FTZ to FTZ without incurring duties or, for the case of Malaysia, any otherwise applicable sales tax thus saving money on the overall manufacturing cost. While most companies are focused on using FTZs for exports, FTZs can also be used to take advantage of crossdocking and transferring goods from one FTZ to another without paying Customs duties.

While activities in the FTZ are independent of the Customs department, they still have the right to conduct regulatory audits to determine whether FTZ operator declarations, procedures and recordkeeping systems are in conformity with rules and regulations. Larger companies may want to consider using automation to help alleviate the burden of managing the FTZ process, particularly since with high-volume operations it can be extremely difficult, if not impossible, to manage manually. The data needed for classifying goods, for example, is voluminous and frequently changes and must be pulled from country-specific lists. Software that has this information in a central repository with automatic updates can pull information from different systems, such as import/export and warehouse management systems, and use that data for Customs filing and inventory management.

2 Comments

Jennifer Leong

22/3/2021 12:19:20 pm

Hi there, sure! The team at [email protected] will be in touch shortly. In the meantime, have a good day :)

Reply

Leave a Reply. |

Search by typing & pressing enter